How Truewind’s Classification Engine Transforms Accounting

Product

How Truewind’s Classification Engine Transforms Accounting

By using AI, our engine helps firms dramatically improve their transaction coding. From reducing manual workloads to elevating accuracy, it’s having a major impact on the way that teams manage financial data.

At Truewind, we're dedicated to making accounting simpler, faster, and more accurate.

To that end, one of the most effective tools we’ve developed is our Classification Engine.

It’s AI-powered, automates complex processes and improves efficiency across the board.

By reducing manual workloads and minimizing errors, our engine helps teams save and invest more time into other areas of their business.

Below, we’ll delve into the details of how it works, the problems it solves, and the benefits it provides for accounting firms.

The Challenge of Handling Transactions

Accountants spend a lot of time organizing bank and credit card transactions—a process known as “transaction coding.”

This involves four main steps:

Identifying the payee: Determining who the transaction is with

Categorizing the account: Categorizing the type of transaction

Choosing the class/department: Defining the tracking category for a Profit & Loss transaction

Matching transactions: Matching transfer transactions between financial institutions, matching payments to bills, or matching collections to invoices

Once these details are determined, transactions are added to the company's general ledger.

However, with many accounting software solutions, this process still requires considerable manual work for several reasons:

Lack of automation: No automation for creating new vendors/customers

Manual rule management: Relying on accountants to add, evaluate and edit automation rules

Manual approval: Relying on accountants to either accept or reject suggestions from the system, even if they’re very straightforward

How Truewind’s Classification Engine Helps

At a high level, our engine is designed to serve as a co-pilot for accountants, offering a blend of suggestions and automated decisions.

To that end, here are four ways we achieve this:

1. Automating Syncing Transactions

Our engine not only provides suggestions, but also evaluates them based on confidence level and transaction materiality.

Then, it automates the posting of high-confidence, non-material expenses to the general ledger.

For clients with a high volume of credit card transactions, accurately automating 90 percent of these transactions saves substantial time and significantly reduces errors associated with manual entry.

Additionally, if needed, our system allows for easy reversals or adjustments.

2. Cleaning Up Messy Books

When a client isn’t happy with the performance of their firm, and decides to switch, it often means that their new firm will be inheriting disorganized books.

If the new accounting team is using QBO, which relies on historical data and manually created rules, the lack of high-quality data that they’re left to deal with creates a real problem.

Truewind’s Classification Engine, on the other hand, doesn't solely depend on historical transactions.

We can identify discrepancies, make new predictions, fill in missing data, and correct inaccuracies. This ensures a clean slate moving forward and significantly reduces time spent on data cleanup.

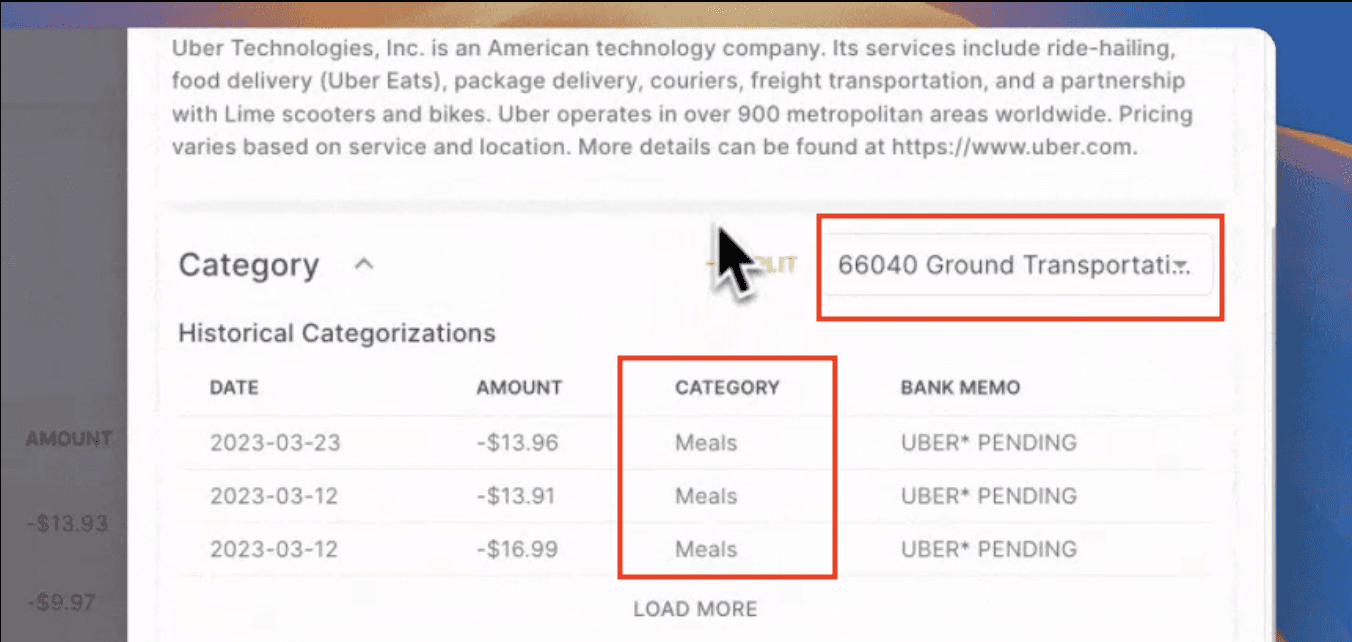

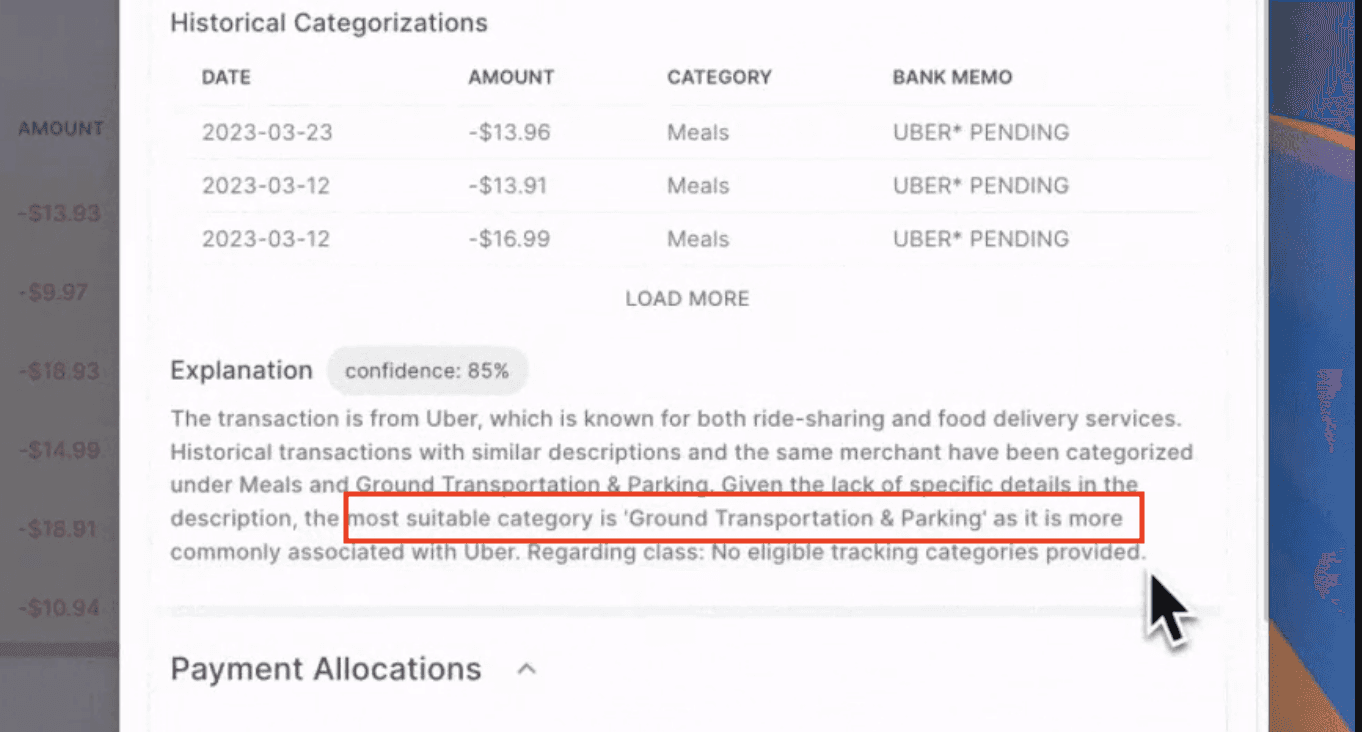

3. Smart Predictions

Our Classification Engine excels where rule-based systems fall short, especially when dealing with incomplete historical data.

For instance, if past transactions lack details like the payee or expense type, our engine can still make accurate predictions to fill in those voids.

With the help of AI, we go beyond just replicating past behavior, and adapt as needed to maintain the standards required by your firm.

4. Broader Scenario Coverage

We cover a wider range of scenarios compared to existing technologies like QBO.

Our engine can:

Match expenses to the correct bill and deposits to the correct invoice

Predict whether transactions are prepaid or accrual expenses based on the service period indicated in bank transaction memos

Avoid duplication by checking if the same transaction already exists in the general ledger.

QBO, in contrast, may list multiple invoices with the same amount, but not actually narrow down options based on date and memo details.

Truewind’s broader and more precise scenario coverage enables enhanced accuracy and efficiency when it comes to transaction coding.

Key Benefits for Accounting Firms

From top 100 firms to solo practitioners, the teams that have integrated our engine into their workflows have seen substantial improvements in the following areas:

Increased efficiency: Automating transaction commitments frees accountants to focus on more strategic tasks

Improved accuracy: Intelligent accounting predictions reduce errors and maintain high data quality

Time savings: Less time spent on manual data cleanup and coding translates to quicker turnaround times for clients

Enhanced client experience: Providing accurate and timely financial reports strengthens client trust and satisfaction

Conclusion

Accurate classification is a foundational step in the accounting process, and significantly influences overall efficiency.

To that end, Truewind’s Classification Engine is a powerful asset for accounting firms, providing unparalleled precision and automation.

By automating transaction maintenance, handling messy books efficiently, providing intelligent predictions, and covering a broader range of scenarios, it fundamentally transforms how teams manage their financial data.

Ultimately, this feature is designed to make the accounting process a lot more streamlined, accurate, and efficient.

Interested in the benefits that our Classification Engine provides? Get in touch with us here.