From Our CEO: Reflecting On The Family Office Fintech Summit

Truewind

From Our CEO: Reflecting On The Family Office Fintech Summit Min Read

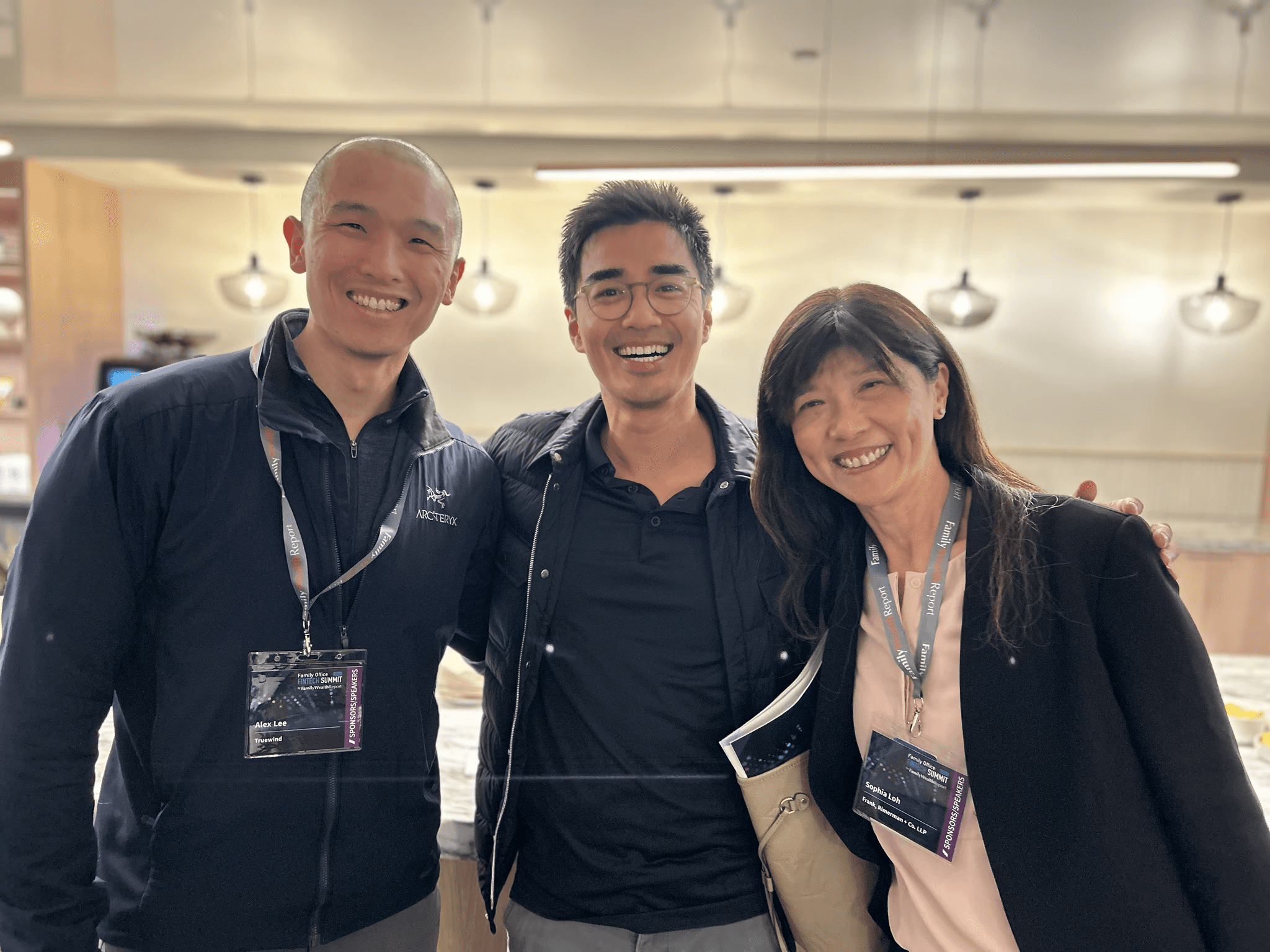

*We’d like to thank Sophia Loh, our partner at Frank, Rimerman + Co., for inviting us to speak on a technology panel.

Family Offices Embracing AI with Truewind

Our panel, “AI in the Accounting and Finance Functions of Your Family Office: Why and How to Embrace the Revolution,” focused on how family offices can use AI to simplify accounting workflows, enhance client service, and free up their teams for more meaningful work. Alongside SumIt and BILL, we shared success stories and explored how teams can go about adopting AI tools.

At Truewind, our accounting firm customers support the back-office operations of family offices, and we spoke about the unique challenges that family offices face. This includes things like managing a lot of credit cards, which means a large amount of manual categorizations for accountants. This isn’t hard work per se, but when a family has ten credit cards, each with hundreds of transactions, it adds up to thousands of transactions to code per month. These tasks, while necessary, don’t directly benefit the client. It’s in areas like this where technology can step in and really make a difference.

On our end, we use AI to tackle this challenge using three techniques:

Learning from the Past: Our predictive AI studies previous transactions to suggest the right category for new ones. It’s like having a team member who remembers every detail from past work and applies it instantly.

Understanding the Details: Think of this as an AI that "reads between the lines." It doesn’t just look for keywords in transaction descriptions; it interprets the meaning to provide accurate categorizations.

Asking for Clarity: When the system encounters something unusual or unclear, it uses a conversational approach—asking simple, straightforward questions to ensure the right call is made.

These three approaches work together seamlessly. If there’s a lot of history for a certain type of transaction, the system relies on past patterns to make quick decisions. If not, it leans on its ability to interpret the details or ask for context. By automating the manual work of categorizing transactions, family offices can save countless hours and empower their teams focus on the bigger picture—like delivering strategic insights to clients.

AI isn’t just focused on making things faster; it’s about elevating the role of accountants and helping family offices thrive in a way that’s far more efficient.

The Panel’s Questions: Views on AI

We covered a handful of complex questions around AI. Below, I’ve shared our rapid-fire answer to each one:

1. Why Is AI Essential? Share How Adopting AI Has Impacted Your Clients?

At its core, AI is a transformative technology, much like the mainframe, the internet, and mobile devices that came before it. When harnessed thoughtfully, these innovations have the power to elevate society, driving progress and improving lives. However, when misused, they can disrupt the very fabric of our communities. The real question, then, isn’t whether AI matters—it’s how we choose to wield it to create a better future for everyone.

At Truewind, our mission is to help accountants reclaim the purpose that drew them to the profession in the first place. Professionally, this means enabling you to excel in your role as a trusted advisor, and deliver meaningful value to your clients and business partners. Personally, it’s about fostering a life of stability, balance, and well-being. This commitment to supporting accountants is at the heart of everything we do, and we’re making significant strides toward this goal. For example, accounting firm partners report that our AI-powered tools have cut the time required for certain workflows by 50-75 percent, freeing up valuable hours for higher-impact work.

2. Could You Share the Most Common Reasons Why the Adoption of AI/Technology Is Often Unsuccessful?

In short: misaligned expectations. One of the biggest challenges we see is the misconception that AI can automate 100 percent of tasks. While this may become a reality in the future, it’s not where the technology stands today. It’s worth noting that conversations about automating accounting have been happening since the introduction of JavaScript in 1995, yet much of the work remains manual even now.

At Truewind, we work closely with our customers and delve into the details of what AI can realistically achieve. Our solution delivers 80 percent automation, with the remaining 20 percent requiring human expertise for oversight and refinement. By aligning on this, we establish a strong foundation for partnership, enabling us to integrate cutting-edge AI tools into client workflows effectively.

3. When It Comes To Questions Related To AI/Technology Security, How Do You Address Customer Concerns?

We take a two-pronged approach. First, we meet all the basic requirements of being SOC 2 certified and having Data Processing Agreements in place with our strategic vendors. You can see our Data Trust Center, which is listed publicly on our website.

Second, we go beyond the basic security certification requirements. For example, when we use OpenAI or Anthropic’s Large Language Models (LLMs), we redact client names from the data flow. This means, that in the worst-case scenario of a data leak, the information would never be tied back to the client. These added precautions underscore our deep commitment to protecting our customers and upholding the high standards we have for security.

Seeing Old Friends

One of the best parts of the Family Office Fintech Summit was reconnecting with friends who are shaping the future of our industry.

Alex Lin, the co-founder and CEO of SumIt, is making it easier for family offices to manage their accounting by creating a platform where they can see all their entities in one place. Sophia Loh, partner at Frank, Rimerman + Co., is a leader in helping clients grow their wealth and businesses while planning for the future. I was fortunate enough to meet them both at the AICPA Engage conference earlier this year, and four months later, we’re doing a panel together.

Looking forward to continuing this journey with Alex, Sophia, and others who are paving the way. Together, let’s keep supporting accountants and family offices, and enable them to invest more time into building relationships, delivering strategic insights, and driving progress.

Interested in learning more about Truewind and our AI-powered solutions? Chat with our team to get started.