Blog Article

The Next Generation of AI-Powered Accounting Tools

Alex Lee & Sasha Orloff

Puzzle

•

Truewind

Generative AI

Sep 12, 2024

With the help of AI, accounting can be transformed from a traditional cost center into a strategic effort, much like Financial Planning & Analysis (FP&A). By decreasing costs, improving accuracy, and enhancing timeliness, AI-powered accounting becomes a powerful tool for driving business operations forward.

More than anything, AI-powered accounting matters because it helps companies make better informed and more strategic decisions.

Founders often speak about the challenge of "flying blind," but with AI, they gain real-time insights that guide crucial choices—whether it's managing cash flow, planning investments, or adjusting operations in response to market changes.

With Large Language Models (LLMs), we can gather insights and make improvements in every area of accounting, addressing some of the most pressing pain points that businesses face.

From understanding the context behind each transaction to reducing errors and enhancing customer support, AI helps tackle the inefficiencies and manual burdens that often slow down financial operations.

These pain points—such as time-consuming reconciliations, error-prone data entry, and delayed reporting—can severely hamper a company's ability to operate smoothly and make timely decisions.

In essence, AI transforms accounting from a repetitive chore into a formidable tool for business intelligence, allowing companies to overcome these challenges and drive growth.

In this article, we'll explore why there’s a critical need to further integrate AI into accounting and how it can help companies elevate their financial operations.

Understanding business context

Effective accounting is more than just crunching numbers; much of it hinges on understanding the context behind each transaction.

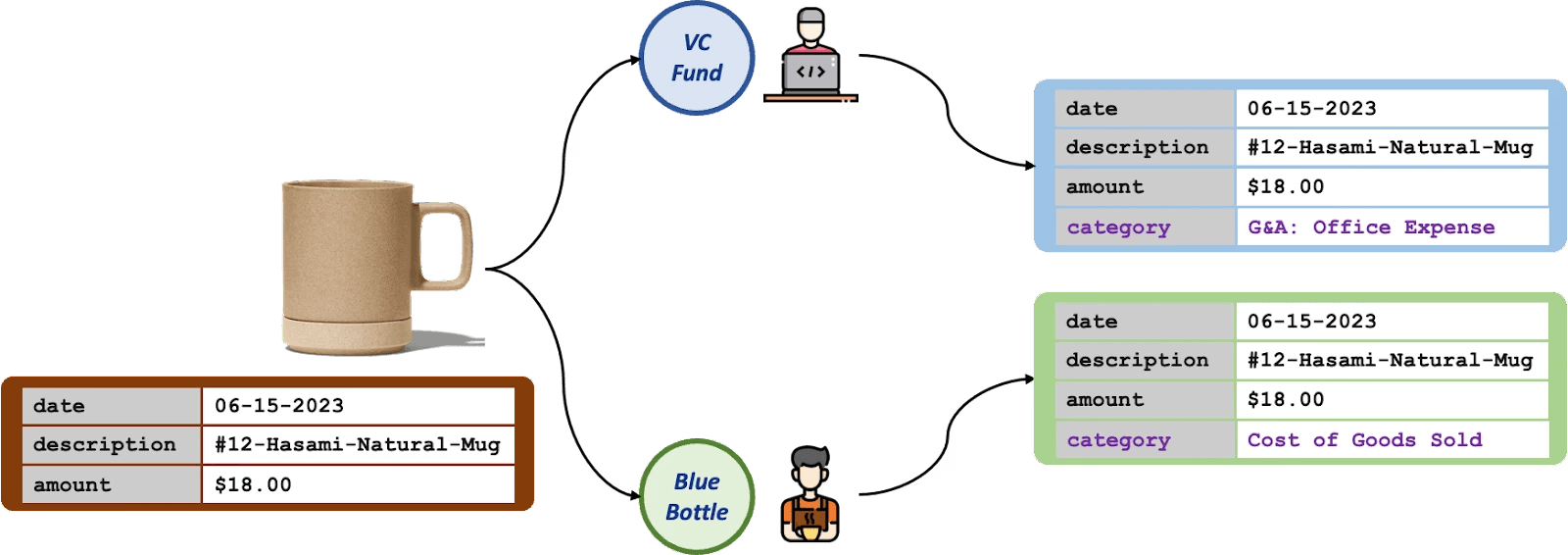

As an example, think about two businesses buying a coffee cup.

For an insurance agency, that purchase is “an office expense.” However, for the Starbucks down the street, it's “a cost of goods sold.” The item might be identical, but its purpose and classification are completely different.

Traditionally, the only way to handle these types of distinctions was through manual interpretation.

Specifically, this meant that accountants had to analyze the purpose behind every purchase and classify it correctly.

While accounting software has introduced rules to automate some of this process, they’re often rigid and struggle to capture the nuances of every transaction.

As companies grow and the number of transactions increases, relying solely on predefined rules becomes even more challenging, as they may not account for the complexities and variations in business activities.

It’s in areas like this that LLMs can really make a difference.

LLMs have the ability to interpret and process natural language inputs, meaning that they can understand the context behind transactions with remarkable accuracy.

They don't just see a coffee cup; they understand whether it's an office supply or inventory for resale.

How AI takes business context into account when categorizing.

By accurately grasping this, AI can provide deeper insights into spending patterns and operational efficiencies.

For instance, it can highlight trends in office expenses, suggest cost-saving measures, or identify anomalies that might indicate fraud. In the past, that level of insight was only achievable with extensive manual analysis.

In essence, AI's ability to capture and analyze context at scale enhances every facet of accounting. It frees up accountants to focus on more strategic tasks, ensures higher levels of accuracy within financial reporting, and provides valuable insights that can drive business decisions.

AI-powered bookkeeping and accounting: a powerful partnership

In terms of the relationship between AI-powered bookkeeping and accounting, think of them as a two-part team that handles your business finances efficiently.

Here’s how it works:

AI-powered bookkeeping: This is like a super-smart assistant that records every financial transaction—money going in and out. It’s fast, accurate, and never gets tired. It does the routine work of keeping everything organized, from tracking sales to expenses.

AI-powered accounting: Once the bookkeeping is done, AI-powered accounting steps in to make sense of the data. It’s like having a financial expert who interprets the numbers and turns them into insights, like showing you trends, where you can save money, or where you should invest more.

So, while bookkeeping keeps your records clean and organized, accounting helps you understand what those numbers mean, giving you useful information to grow your business.

Together, they create a complete financial system that helps you not just manage your money but also make smarter business decisions based on real-time insights.

Reducing human errors

Another significant advantage of AI-powered accounting is its ability to minimize human error.

Given the number of repetitive tasks within accounting, and the fact that each step requires meticulous attention to detail, it's easy for mistakes to slip through.

One common theme we've heard from customers is that when it comes to addressing the manual aspects of accounting, there really isn’t a single mountain to conquer.

Instead, it feels more like tackling a series of small hills. Each task may seem manageable on its own, but when done by hand, they become overwhelming.

With the help of AI, and through automating data entry, reconciliation, and other routine processes, we can dramatically reduce the risk of errors that can creep in through manual oversight.

Also, the accuracy provided by AI isn't just about preventing mistakes—it also helps with building trust.

When financial records are accurate and reliable, it puts companies in a better position to plan and adjust aspects of their operations.

Ultimately, this level of precision leads to a strengthened sense of confidence between businesses and their stakeholders, from investors to clients, and fosters a more transparent and dependable relationship among parties.

Delivering speed

For startup founders and business owners, speed is just as crucial as accuracy when it comes to accounting services.

Waiting until the 20th of each month for financial statements, as is common with traditional accounting, can be incredibly limiting, especially if you’re in an industry that moves rapidly.

At Truewind, we leverage AI to cut down on this waiting period. By using advanced algorithms and automation, we’re able to deliver books to our customers by the 15th of the month, and in many cases, by the 10th.

The goal isn’t to be faster just for the sake of speed; it’s about empowering business owners with timely, accurate information.

Whether it’s deciding on a new hire, making an investment, or adjusting your budget, having access to up-to-date financial data enables you to act quickly and confidently.

Enhancing customer support

AI-powered accounting also helps elevate the quality of customer service that clients receive.

With routine tasks automated, companies can focus significantly more on addressing complex queries and providing personalized assistance.

This shift means that when a client has a question or faces a challenge, they’re not met with a generic response or a long wait time. Instead, we’re able to provide them with thoughtful, tailored support that meets their specific needs.

Moreover, AI tools enable us to take a proactive approach to assisting our customers.

By continuously monitoring financial activities and flagging potential issues before they become problems, we can alert clients to discrepancies, unusual patterns, or opportunities for optimization.

From our perspective, the human touch in customer support is irreplaceable, and with the boost from AI, we’re able to enhance this crucial aspect of accounting even further.

Conclusion

Ultimately, the integration of AI-powered accounting is more than just an upgrade; it's a transformative shift that redefines the scope of accounting.

By providing a deeper understanding of business context, minimizing human errors, speeding up financial reporting, and enhancing customer support, we can help companies operate with unprecedented efficiency and accuracy.

At Truewind, we're dedicated to driving this change, and ensuring that businesses are equipped with the tools they need to make informed, strategic decisions.

As we continue to innovate and harness the power of AI, we look forward to helping our clients achieve new heights through accounting that’s intelligent, precise, and incredibly impactful.

To close out, we’d like to share a few words from Fouad Farhat of Soma Capital, which is an investor in both Truewind and Puzzle, about the current state of accounting, and where it’s headed:

"Let's face it, finance and accounting aren't the most glamorous terms in the startup world. Traditional tools like QuickBooks just don't cut it for startups. And hiring a fractional CFO can be pricey and adds another layer of complexity. We think founders deserve better, a platform that makes financial data crystal clear and easy to understand. That's why Truewind and Puzzle are poised to win."

Truewind is using generative AI to power accounting workflow automation for accounting firms and world-class bookkeeping services for startups and SMBs. Interested in learning more about our AI-powered solutions? Chat with our team to get started.

Puzzle is the accounting OS built for startups, replacing outdated tools like QuickBooks. We know founders have a lot to juggle, so we created next-gen software to make life easier. Puzzle gives you clear, easy-to-understand financial insights and simplifies taxes without the hassle. Smarter accounting, designed for startups. Grab a free demo here.

Soma Capital is a VC fund backing fearless generational company builders at the earliest stages possible. The fund was early in 20+ unicorns since inception in 2015.